If you’re like the rest of us, paying taxes is painful and necessary, but we all only want to pay our fair share and no more than that.

However, what if it could be less painful?

If you have read the book Farming Without the Bank or watched the video of how it works you can see that your money NEVER leaves your whole life policy cash value when you borrow against it. Not for any reason, even if that reason is to pay taxes! By first putting your taxes into cash value of the policy you are able to turn around and access it within 30 days to pay Uncle Sam.

So what is the benefit to farmers?

Let’s say your taxes are $30,000 and you have $30,000 in your life insurance cash value, you can borrow against that to pay Uncle Sam. You continue earning interest while you do this! You are making money on the money you sent to Uncle Sam!

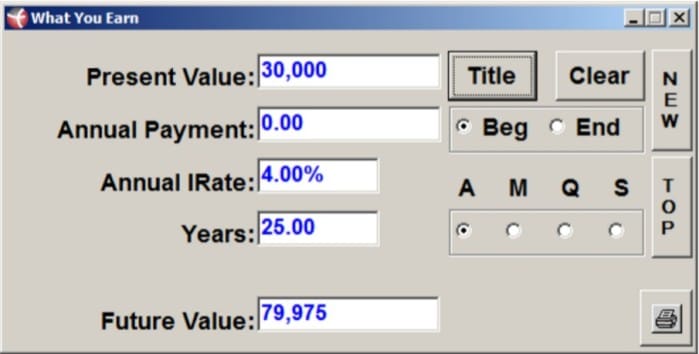

Below is a calculation of what your $30k will continue to earn in your policy for the next 25 years – $49,975! ($30,000-$79,975) if that tax bill is higher, the amount lost is just higher. Paying cash comes at a cost. Think about that for a minute!

Now you may be saying, “I will have to pay the $30,000 loan back to the life insurance company with interest.” You sure do and if you pay 5% on that loan over a year’s time your interest is $818.64.

Are you willing to give the insurance company $818 so you could earn $50,000? The bigger question, are you willing to plan 30 days in advance and put it into cash value to just turn around and borrow it back out to pay Uncle Sam?

Paying Uncle Sam with cash is costing you lost opportunity cost on your money. I’m saying there are better ways to do this. The true cost of that $30k tax bill is $80k!

Moral of the story, before you pay your taxes, take a look at the Farming Without The Bank if you have it and get it if you don’t. Also, google a future value calculator to see what your true cost of taxes is at a 4% loss of money until your death!

If you have the book and have read it, call me today to schedule your no-obligation, free consultation.

We’ll cover:

#1. How this can be flexible enough to work for you.

#2. What amount of premium is right for you.

#3. What your biggest objective is and how we can get that taken care of.

It’s my gift to you. It’s free, it’s quick and I’m not pushy….until you learn, how can you tell me I’m wrong?

May your tax season be stressless.

Mary Jo Irmen

701-751-3917

Bismarck, ND

I ordered this darn book over a year ago I think and still haven’t read it and whenever I see your emails or posts on facebook it reminds me to do so. I do want to read this book and get a hold of you because the little I have read is that it all makes sense.

Chad! Read the book! We’re ready to help you put it into action.

Mary, how is interest on a policy loan calculated? It seems to me that 5% on $30,000 should be around $1500/year, depending on the compounding frequency.