Lost Opportunity Costs – Cash is NOT King

Lost Opportunity Costs – Cash is NOT King

Most people have never heard of Lost Opportunity Costs, just as I hadn’t prior to teaching this concept. By us not knowing, we are losing money on a daily basis while those who know are taking that money from us and putting it to work for themselves.

What is it? It is the opportunity you lost to make interest on money because you spent it on something else.

Some would say, you used that $100,000 income and bought yourself a new semi. You gave the seller your money in exchange for a semi. You no longer have that $100,000 to invest or purchase anything else with, it’s gone FOREVER. YOU LOST THE OPPORTUNITY TO MAKE MONEY.

This same concept applies when you sell grain and take that money directly to the bank. Using large sums of money to put directly towards expenses leaves you with a lost opportunity to put that money someplace that will make you money.

Stick with me here…

Let’s say you sell grain/cattle and make $100,000 more than you are obligated to pay the lender. You decide you are going to use that $100,000 as payment on land so you can get your land paid off sooner. If you do that, you lose the ability to make interest and can never use that money again! Poof, gone, the lender got it.

Instead, you could have put that money in a tool that allows you to earn interest AND use it at the same time! Yes, you could have earned a guaranteed interest rate and paid the lender off. Two goals accomplished at the same time.

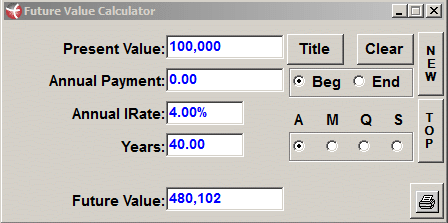

You do this by using the tool of dividend-paying whole life insurance which pays you compounding interest all while you borrow against your money to pay off debt. Compounding interest is very powerful, so much so that Einstein called it the eighth wonder of the world. How powerful is it? It is so powerful you could turn $100,000 into $480,102.

Below is an example of what this money could do for you if you put it in this tool that allows it to compound at 4% over those 40 years.

You have an extra $380,102.

You CAN have the best of both worlds by using the Infinite Banking Concept. If you put that $100,000 into the policy as a premium payment it will earn you the compounding interest but you will also have access to the money for use. You can still pay down that debt by borrowing against the cash value of the policy.

Before dumping large sums of money onto debt or investment purchases you should be considering the cost of lost opportunity. Putting money into a policy as a premium fist and then borrowing against that money to pay off debt or make purchases will allow you the ability to take advantage of both.

Stop losing compounding interest by taking money to the bank first or buying things with cash.

CASH IS NOT KING. I like to say cash is queen. This is shocking and takes a minute or two to get your head around. When you purchase with cash you have given it to someone else. When you borrow against cash value your not only make your purchase but your money continues to earn compounding interest. You will see this in the How It Works video. If you haven’t watched it do it now.

Waiting to start a policy has the same effect. Each year you wait to begin the more compounding interest you have given up.

Don’t think you have to have a $100,000. Any amount of money compounds and creates wealth, $5,000 will earn you the same rate of return the $100,000 did. If you want to play with some numbers there are plenty of free future value calculators online you can use. Here is a link to a good one: http://www.moneychimp.com/calculator/compound_interest_calculator.htm

Stop thinking bank or cash first and start thinking wealth building and storage.

As always I look forward to comments, emails or calls.

Mary Jo